How a Mortgage Refinance Can Help You Out in 2022 Thanks to the Covid-19 pandemic, mortgage interest rates have been at a record low for the past two years. Due to this, it had been a great time for homeowners who wanted to refinance their mortgages. However, with the market reopening and interest rates going…

Read MorePosts by CMSadminNew

What you should know about second mortgages

What you should know about second mortgages When it comes to mortgages, second ones always seem to have a bad reputation. As if financially, nothing good can off a second mortgage, and without getting into the nitty-gritty of it, you might think that’s true. However, it’s not correct at all and this blog post is…

Read MoreRefinancing Your Mortgage While Unemployed

The recession is still affecting plenty of homeowners who are finding it extremely difficult to keep up with their mortgage payments. A likely solution is to refinance your mortgage and take advantage of the current low-interest rates so that your monthly payments become affordable. The question a few may ask is, will I be able…

Read MoreWhat Are the Advantages of a Debt Consolidation Loan?

Between making your credit card payments, home loans, or even student loans, it can be quite stressful to keep track of one’s payments and outstanding debts. The most efficient way to streamline your finances would be to consolidate all your debts into a single loan payment with a manageable monthly payment structure. However, it will…

Read MoreWhat you should know about second mortgages?

When it comes to mortgages, second ones always seem to have a bad reputation. As if financially, nothing good can off a second mortgage, and without getting into the nitty-gritty of it, you might think that’s true. However, it’s not correct at all and this blog post is here to make you understand why applying…

Read MoreCan I Get a Mortgage With Bad Credit in Toronto?

In Canada, an important financial indicator for any person to get a mortgage is their credit score. But how do you know that if you have a poor credit score in the first place? The score assigned by the credit bureau is anywhere between 300 and 900. If you have a credit score that is…

Read MoreHow a Mortgage Refinance Can Help You Out in 2022

Do you have less than six months or less left on your current mortgage? If yes, you should have started exploring your renewal options with your current mortgage lender, including researching online with other lenders. A mortgage renewal usually takes place when your mortgage term is done or close to coming to an end. The…

Read MoreHow Long Before Your Mortgage Renewal Date Can You Renew Your Mortgage?

With mortgage rates at an all-time low, properties have built up a lot of equity all over the country. This is why 2022 is the time to unearth your equity with a mortgage refinance. When you are looking to refinance your mortgage, you must keep in mind: If you are looking to save on interest…

Read MoreWhat down payment do you need for a second mortgage?

Are you surveying the real estate market to purchase your dream family vacation home? There is a strong chance that you will be required to get a second mortgage on your existing property to purchase that one. A second mortgage is completely different from applying for a mortgage on a primary residence. While most individuals…

Read MoreHow to get a mortgage when you have bad credit?

With the recent changes in mortgage application guidelines, more and more Canadians are having their mortgages rejected, even if you have a steady stream of income, being self-employed can be one of the reasons why your mortgage loan was not accepted. On top of all of this, if you have a bad credit score, you…

Read MoreWhen Is The Best Time To Refinance Your Mortgage?

There are many ways to improve a financial situation, and for you, it may be refinancing your mortgage. If you are looking to lower rates, lower monthly payments, use home equity, or simply change the terms of your mortgage, refinancing could be for you. When is the best time to do refinancing? How do you…

Read MoreHow to get the best and lowest mortgage rates?

Purchasing a home is one of the significant financial decisions one will make in their life, and it is most likely that you will require a mortgage to pay for the purchase. Are you looking for the best mortgage rates to purchase your dream house? The best place to start is by using a mortgage…

Read MoreFour Tips to Qualify for A Home Purchase In 2021

If you’re planning to purchase a home, you already know that you’re making one of the biggest financial investments in your life. You have made your best effort in saving a bit from your paycheck and now have enough to pay the down payment and get the front door keys of the front door of…

Read MoreHow Bad Credit History Affects Your Mortgage Options?

When it comes to getting a mortgage, you want as many options as possible. These options, however, are affected by credit scores and credit history. It is important to have a good credit score and history, as they allow you more options in financial situations. Mortgages are a big part of these financial situations. You…

Read MoreHow Long Before Your Mortgage Renewal Date Can You Renew Your Mortgage?

Do you have a mortgage? Did you get a notice warning you of renewal coming up? There is no need to worry. Mortgage renewal gives you the chance to go over what worked and what didn’t in your current mortgage term and lets you improve things for the new term. If you are wondering how…

Read MoreFour Tips to Qualify for a Home Purchase in 2021

Are you looking forward to beginning your home-owning dream? Is 2021 the year for you? Before you begin looking at houses, you may need to consider a few things. It is a good idea to make sure your finances are good and in order. You may find a house you like, but it’s your finances…

Read MoreEverything You Need To Know About Private Lending

No one should have to struggle to get a loan. If you are struggling, don’t give up. There are other options to regular loan lending. Private lending is available to help those who can’t usually qualify for a loan. Private lending may be the way to go if you are having issues with the…

Read More10 Things to Consider Before Renewing Your Mortgage

Your mortgage term is nearing its end, and you’ve been notified of the possibility of renewal. Before jumping in to sign the renewal right away, there are a few things to know before you continue with the Mortgage Renewal process. Although things may seem much quicker and easy by just staying with the current…

Read MoreImportant Things to Know Before Refinancing your Home

When your current mortgage term is coming to an end, you will have a chance to renegotiate terms and rates. This mortgage renegotiation is called refinancing, and it can do many things like pay off your mortgage faster, save money and build home equity. What is Refinancing a Mortgage? Refinancing is when you take your…

Read MoreHow Can Home Equity Loans Help You Finance Your Business?

You may have heard of Home Equity Loans for residential situations. It may be a little harder for you to believe that you can use this type of loan for financing your business. Home Equity loans can definitely be used to buy, assist, or finance a business in many ways. Like any other Home Equity…

Read MoreWhy and When you should refinance a home

With the many types of mortgages and financial solutions flowing around today, you may be wondering which one is right for you. If you are struggling to make payments on your mortgage, and are looking for ways to lower payments, refinancing your home may be the answer. Matrix Mortgage Global is ready to help you…

Read MoreTop reasons Why You Should Get A Second Mortgage in 2021

Matrix Mortgage Global is a team of committed and experienced mortgage brokers, who want to help you and your family to take care of your financial responsibilities and achieve your dreams in 2021. Those dreams may need the help of a Second Mortgage. What is a Second Mortgage? A second mortgage is a mortgage…

Read MoreWhen You Should Consider a Second Mortgage?

With the variety of loans available today, you know there is going to be the perfect one for you. A second mortgage is set up to help those in many different situations, but if it suits you and your financial obligations, it could make all the difference. What is a Second Mortgage? A second…

Read More5 Reasons to Tap into Your Home’s Equity Loans?

Did you know your house is more than just a home? Your home is an investment, and a source of money ready to help with improvements, education repairs, and emergencies. Using your home’s equity can be a quick and easy way to improve a financial situation and pay for surprise costs. What is Home…

Read MoreHow to Get the Best & Low Mortgage Rates in Canada?

We all want to find the best and lowest rates for a mortgage. Here are some helpful tips to help get the lowest mortgage rate you possibly can. Credit score matters. It actually plays a big part in the mortgage rate you will qualify for. Paying down any debts will help improve a credit…

Read MoreInside Matrix Global’s new partnership with Mortgage Centre Canada

Late last week, Matrix Mortgage Global, the award-winning, Scarborough, Ontario-based brokerage formerly aligned with Verico Financial Group, announced it had entered into a franchise agreement with Mortgage Centre Canada, part of Dominion Lending Centres’ network of brokerages. According to Shawn Allen, founder and CEO of Matrix, the decision to go into business with Mortgage Centre…

Read MoreIs cryptocurrency the future of the mortgage industry?

For Shawn Allen (pictured), cryptocurrency and blockchain technology represents the future of the mortgage industry – and he’s determined that Matrix Mortgage will be at the forefront of it. The company’s founder and principal owner told Mortgage Broker News that blockchain and decentralized finance were set to “take the whole industry by storm” as Matrix…

Read MoreMatrix Mortgage Global COO explains how many hands make good work

Strong alliances and support networks meant that starting young did not prove to be a barrier for Laura Martin (pictured), chief operating officer at Matrix Mortgage Global. Diving headlong into mortgages back in 2007 at the age of 20, Martin cited one of her earliest professional partnerships as a crucial component of her formative years…

Read MoreCanadian Broker Enables Bitcoin, Ethereum, and Ripple Payments

Matrix Mortgage Global customers will be able to use BTC, XRP, ETH, BCH, and several stablecoins to pay for company services. The narrative that cryptocurrencies are not used as payment methods continues to be debunked, with numerous companies enabling such transactions lately. One of the largest Canadian brokers, Matrix Mortgage Global, is the latest to…

Read MoreAlternative lender to begin accepting cryptocurrency for services rendered

Matrix Mortgage Global announced earlier this week that it will begin accepting cryptocurrency as payment. The alternative lender said that its goods and services can be fulfilled with Bitcoin, Bitcoin Cash, XRP, and ETH, along with several dollar-pegged stable coins. This includes Mortgage Agent Registration cost using BitPay. Matrix said that this step positions the…

Read MoreAccepts Cryptocurrency for Payments

Matrix Mortgage Global, Canada’s 3x Broker Of The Year, today announced the company is accepting Bitcoin, Bitcoin Cash, XRP and ETH, as well as several dollar-pegged stable coins, for payment of goods and services including Mortgage Agent Registration cost using BitPay. The ability to accept cryptocurrency expands Matrix Mortgage Global into international markets where accepting…

Read More10 Useful Tips To Help You Refinance Your Mortgage For A Better Rate!

If you are wondering whether or not you should refinance because you want different rates, don’t worry. There are quite a few ways to find the best rates for your financial situation. Let’s look at ten helpful hints to help you refinance your mortgage for better rates. What Is Refinancing and What Does It Do?…

Read MorePros and Cons of home equity loans

There is no need to struggle when looking for a mortgage to achieve your financial dreams. You can experience many benefits when getting a private mortgage, and with today’s lending requirements, private mortgages may be just the right thing for you. Can you save money with a Private Mortgage? Of course. What Is a Private…

Read MorePrivate Mortgage Tips & Advice to Help You Save

Do you have financial dreams or goals that just seem a bit out of reach? For some, a Home Equity Loan can help achieve those goals and make dreams come true but converting equity into cash. A Home Equity Loan allows you to have the flexibility to choose which costs to cover, especially with large…

Read MoreStop the Power of Sale Process!

As a homeowner you have worked hard to make your home just the way you want it. So, the prospect of losing your home can be scary and emotionally devasting. But that is exactly what can happen if you begin missing or falling behind on your mortgage payment. When a mortgage holder starts to miss…

Read MoreMatrix Mortgage POS vs Foreclosure

During difficult times, finances may get tight and force you to make decisions you really don’t want to make. For those tough times, when it comes to houses, you may be faced with the possibility of being forced to sell your home. There are two ways this sale can occur. One way to sell is…

Read MoreUsing a Second Mortgage to Get Out of Debt

For some homeowners, the idea of taking out a second mortgage sounds scary – after all, how can they manage two mortgage payments. But when you take out a second mortgage in order to pay off debt, the result is often that you end up saving money because you are lowering the total interest rate…

Read MoreBad Credit And Repayment

Bad credit mortgage Have you missed any credit payment in the past? Are you worried about your mortgage repayment? Is bad credit getting in the way of realising your dreams? If your answer to any of these questions is ‘yes’ then you can reach out to us and we’ll help you get through this cycle.…

Read MoreIs Buying a Home the right move for you? A look at the surging Market

The last five months have been full of surprises, especially in the Canadian housing market. The great news is that there is a strong surge that has been observed in sales after the spring slump, and this growth seems to be gaining strength as we move into fall. Homeowners are happy with their purchases and…

Read MoreCould a Reverse Mortgage be a good option for you

What a year 2020 has been for the marketplace: massive job losses, an erratic stock market, and low interest rates caused by the pandemic have some Canadian seniors thinking about getting a reverse mortgage. Since March, reverse mortgage borrowers racked up an extra $113.04 million in reverse debt, which is about 30% lower than the…

Read MoreA Financial Program designed specifically for Small Businesses

The financial hardships due to COVID-19 have become very real for business in Ontario. Statistics Canada indicates that the pandemic has led to a significant in crease in business closures, and a decrease in business openings. In April 2020 business closures were more than twice than what was observed in April 2019, and openings fell…

Read MoreIs this right, or is it a Misplot? GTA Real Estate Sales See Biggest July In Over 10 Years!

Greater Toronto is following a current North American wide trend – flight to the suburbs. There’s been a surge of real estate sales, and this is due largely to the detached suburban segment. Suburban inventory is becoming significantly tighter compared to last year. Greater Toronto real estate is seeing a big jump in sales, and…

Read MoreAugust 2020 was a hot month in Vancouver, but we are not talking Weather!

Many people who make a living in Vancouver cannot afford to buy a detached home in the city. Like in many larger cities, people will commute to the suburbs, where freestanding houses cost less. It appears that there have been some shifts in the Vancouver Market, and Matrix Mortgage Global was curious as to exactly…

Read More6 On-going Supports to bolster Covid-19 Recovery Efforts

Small (new) to medium businesses in Canada are significant contributors to the economy of the country. Covid-19 has made it difficult for small to medium businesses to thrive the way they would if the economy was stronger, so the federal government has brought in various programs to nurture the growth of these businesses. The team…

Read MoreDeferred or skipped mortgage payments are due soon are you prepared?

In a report on Thursday, the Canada Mortgage And Housing Corporation looked at the state of the mortgage market in Canada. This year’s numbers, as is the case with just about everything else, was viewed through the prism of COVID-19. One crucial aspect was identified; more than three-quarters of a million Canadian homeowners have either…

Read MoreCANADIAN UNITED IS CURRENTLY ACCEPTING APPLICATIONS FROM SMALL BUSINESSES

CANADIAN UNITED IS CURRENTLY ACCEPTING APPLICATIONS FROM SMALL BUSINESSES FOR A RELIEF GRANT UP TO $5,000.00 Royal Bank of Canada, ‘Corporate Canada’, Business Associations and Major Media Partners have teamed up to start the #CanadaUnited campaign, a nationwide small and local business campaign encouraging Canadians to buy local. In support of small and local businesses on…

Read MoreFederal Government Announces the Extension of two Pandemic Support Programs

It cannot be denied; Canadian companies are facing critical challenges. These challenges have not gone ignored. At the beginning of September, the Federal government announced the extension of two pandemic support programs for businesses. The programs have been set up to help business owners develop their resilience and find new opportunities utilizing: expert advice, insurance…

Read MoreGrowth in new Condominium Apartment Listings Outstrip Growth in other Market Segments

“Generally speaking, market conditions remained very tight in the GTA resale market in August. Competition between buyers was especially strong for low-rise home types, leading to robust annual rates of price growth. However, with growth in condominium apartment listings well-outstripping condo sales growth, condo market conditions were comparatively more balanced, which was reflected in a…

Read MoreWho’s Canada’s 3x Broker Of The Year?

Matrix Mortgage Global – 3X Winner The team at Matrix Mortgage Global is incredibly proud to announce that we have been named Broker of the Year for the third consecutive time by the Canadian Mortgage Awards. The Canadian Mortgage Awards is the largest independent mortgage awards in Canada, and it recognizes brokers, brokerages, and agents…

Read MoreHow to Get a Mortgage with Bad Credit

Getting a mortgage can be challenging enough when your credit is good, but when you have poor credit it can seem like your dream of owning a home is impossible. It is a well-known fact, that the better your credit is, the more favourable your rates and terms are likely to be – but that…

Read MoreBACK TO SCHOOL – A QUICK REFERENCE GUIDE

For the past 5 months, Covid-19 has brought the world to a halt. The viral pandemic has confined us within four walls. With parents working from home and kids taking classes online,there has been a huge shift in our way of life.As things are now beginning to look normal,schools in the country are planning to…

Read MoreEverything you need to know about refinancing your mortgage

If you are considering refinancing your mortgage or if someone has recommended that you should, you probably have a lot of questions about what exactly that means and what it involves. Refinancing your mortgage can be a great way to lower your interest rate, pay off your home loan faster, or even to borrow money…

Read MoreConsumers Enjoying Online Convenience and Won’t Give it up After COVID-19

The COVID-19 health crisis has forced many businesses to go online. Even businesses that previously thought they were “in-person” only are finding that when necessity demands it, they are able to adopt new technology. Now some business owners are probably looking forward to things “getting back to normal” but the truth is that things will…

Read MoreHow to adapt your business in the wake of COVID-19

COVID-19 has changed the ways that consumers interact with business. There are more online sales, and when customers do shop in person, they make less frequent trips with larger purchases. When the lockdown ends, these new preferences are not suddenly going to go away. So how can business owners adapt? Here are a few tips:…

Read MoreEverything you need to know about deferring your mortgage payment

There is no doubt that the current COVID-19 situation is a serious health crisis. But for many Canadians, it is an economic crisis as well. As “non-essential” businesses are being ordered to close, and people are going out less because of social distancing, business is drying up for many and sadly, people are getting laid…

Read MoreThe 2 Minute Rule Productivity Hack

As we all try to orient ourselves in our new COVID-19 Quarantine reality, the idea of work and productivity will be redefined. For many of us, we separated work from home life – had large periods of time to get projects done, and had large uninterrupted stretches of time if we demanded it.…

Read MoreLenders offering mortgage deferrals in wake of COVID-19 crisis.

The current COVID-19 situation is a health crisis to be sure, but it is also an economic one. The markets have taken a severe beating in the last couple of weeks, and with many small businesses being forced to close their doors in this time of self-isolation, it is likely that some of these businesses…

Read MoreHow to refinance your mortgage with bad credit?

To say that these are uncertain times would be an understatement! The COVID-19 virus is not only causing a global health crisis, but an economic one as well. Over the next few months there may be may bankruptcies and job losses ahead. The Government of Canada is doing what it can to mitigate the damage…

Read MoreHow Can I Get A Loan to Pay Off All My Debt?

If you are like many Canadians, you may be struggling with debt. Perhaps you experienced a medical emergency that left you unable to work while your bills piled up. Perhaps you suffered a setback in your business. Or maybe you just made some poor money choices and now you are afraid to answer the…

Read MoreLoans to Pay Off CRA Debt

It’s almost that time of year again. Tax time! If you expect to get a refund from Canada Revenue Agency, you may be excited about tax time. If you know you are going to have to pay taxes, you are probably less excited. And if you are worried that you will not be able…

Read MoreHome Equity Loan vs. Mortgage Refinancing: Which is Better?

Matrix Mortgage Global – Stop Power of Sale with our HOME SAVER program Power of sale, also known as foreclosure can be a scary prospect for any homeowner. Typically, your mortgage will have a clause in it that allows the bank to sell your home if you are not able to make your payments. This…

Read MoreHow a Self-Employed Mortgage Works in Canada?

Business owners are important to our economy. Not only do they provide goods and services that make our lives easier, but they also create jobs and spur innovation. It’s frustrating therefore to see that up until now, many self-employed individuals have had difficulty getting mortgages. This is because when you are self-employed, your income can…

Read MoreHow to Buy a Home in 2020?

If you have decided that 2020 is the year that you will finally become a homeowner, then congratulations! You have made an important decision that will affect your and your family’s future for years to come. But if this is your first home, you may not know where to start. That’s why we have put…

Read MoreHow Much Can You Borrow with a Bridge Loan?

In an ideal world if you wanted to sell your home and buy a new one, you’d be able to sell your house just at the exact moment your offer was accepted on the new one that you wanted to buy. This world however is rarely ideal and sometimes, you find yourself in a…

Read MoreCan I Increase My Mortgage to Pay for Home Renovations?

Whether your home is in need of repair, or you simply want to update a space that isn’t working for you and your family anymore, home renovations can be expensive. Loans on credit cards can be costly with their high interest and even if you have the cash, you may not want to deplete…

Read MoreMatrix Mortgage Global made the top 100 list of the most dynamic mortgage professionals from around the world

Matrix Mortgage Global made the top 100 list of the most dynamic mortgage professionals from around the world. We’re proud to be part of a global discussion of leading mortgage professionals in various markets in the US, Canada, Australia and New Zealand. Twenty-eight Canadians have made it onto the Mortgage Global 100 list, the inaugural annual…

Read MoreHow Much Money Do I Need to Save to Buy a House?

If you are looking to buy a house in Canada, you will need at least 5% for a down payment. Since the average price of a single detached home in Canada is $498, 493, that would mean that you would have to have at least a down payment of $24,947 for that particular home. Keep…

Read MoreWhen Should You Refinance Your Mortgage?

Refinancing your mortgage is when you break your current mortgage in order to get a new one. There are many reasons why you as a homeowner might consider doing this. The following are some examples of when you might want to refinance your mortgage. When interest rates have dropped. The less interest that…

Read MoreHow Can I Get All My Debt Into One Payment?

If you are struggling with a large amount of high-interest consumer debt, it may feel overwhelming and you may wonder whether you’ll ever be able to finally be debt-free. The good news is that there are options to help make paying off debt easier. If you have debt and you are a homeowner, the first…

Read MoreWhich mortgage should I get if I have bad credit?

Having bad credit will most likely mean that you are not going to be able to get the best interest rate on your mortgage. It doesn’t mean however that you can’t or shouldn’t get a mortgage. Knowing which mortgage to get however can be difficult without the help of a professional mortgage broker. If your…

Read MoreHow to get a mortgage with bad credit?

It is no secret that having bad credit is going to make it more difficult to get a mortgage. But that doesn’t mean that you won’t be able to get a mortgage at all. If you have had trouble getting a mortgage from a traditional lender, or you already know that your bad credit means…

Read MoreHow Much Can I Borrow with a Second Mortgage?

If you have built up some equity in your home, then one way to access extra cash when you need it is through a second mortgage. With a second mortgage you can borrow up to 80% of the equity in your home. What is home equity? The amount of equity you have in your home…

Read MoreIs it a Good Idea to Pay Off Debt with a Home Equity Loan?

Many Canadians these days are struggling with high-interest debt. Mortgage solutions such as home equity loans are one option that many homeowners are turning to in order to help them get out of debt. But are these tools really a good idea? That depends. Consolidating your debt and lowering your monthly interest payments can definitely…

Read MoreCan I get a mortgage after a consumer proposal?

After a consumer proposal, it can feel like your whole financial world is in an uproar. You may be wondering whether it is going to be possible for you to get a mortgage and finally move into a place of your own. If you are coming out of consumer proposal and you are wondering how…

Read MoreCan I borrow more than my home is worth for home renovations?

There are several mortgage products out there that you can use to help you fund a home renovation project. These include mortgage refinancing, home equity loans and second mortgages. When you are borrowing from the equity in your home, typically you can borrow no more than 80% (sometimes as much as 90%) of the equity…

Read MoreWhat do I need to get a mortgage if I am self-employed?

If you are self-employed, getting a mortgage can be trickier than if you are simply a T4 employee. In Canada, self-employed individuals enjoy many benefits including being able to write more things off their taxes. And while this results in immediate savings on your taxes, it can have other consequences. When you have a lot…

Read MoreHow can a non-resident buy a house in Canada?

If you are a non-resident who is looking to purchase a home in Canada, you will be happy to know that buyers from all over the world are welcome. There are however a few important details that you should be aware of as a non-resident. What is a non-resident? This is not defined by citizenship…

Read MoreCan you refinance a second mortgage?

Homeowners when they apply for their first mortgage rarely do so with the intention of getting a second mortgage down the road. And if they apply for a second mortgage, it likely doesn’t cross their mind that someday they might want to refinance. But there are several reasons why a homeowner might wish to get…

Read MoreCan You Get a Lump Sum with a Reverse Mortgage?

Reverse mortgages are a tool that Canadian homeowners who are age 55 and older can use to access the equity in their home. A reverse mortgage differs from other mortgage tools like second mortgages in that the homeowner does not need to pay back the loan until they either sell or move out of their…

Read More7 Tips For Getting a Second Mortgage in Vaughan

For those looking to get a second mortgage in Vaughan, there are certain tips that will help you qualify for a second mortgage quicker and easier. This list of tips are not the only solid advice you can get when seeking a second mortgage, but they are a great start. TIP #1 – Be as…

Read More7 Things To Consider When Applying For A Business Loan in Mississauga

When applying for a business loan in Mississauga, there are a number of factors to consider. Securing capital comes down to being prepared and the following tips will provide you with a guideline to use so that you are prepared. Here are seven things that you need to consider. 1. The absolute first thing to…

Read More7 Tips To Consolidate Your Debts in Oakville

In Oakville, there are a number of options that are useful in consolidating your debts. Each option has pros and cons and not every option is available or suitable for everyone. It all depends on your unique situation. Here are 7 Tips that you should consider and use to consolidate your debts. TIP #1 –…

Read MoreHow to Get Qualified for a Commercial Mortgage in Mississauga

Commercial mortgages in Mississauga are extremely popular, but it is important to understand that there are different types of commercial mortgages and that qualification for each type is going to vary someone. Whether you are looking for a commercial mortgage for a rental property, a storefront, or an industrial space, it is critical that you…

Read MoreHow to Get Qualified for a Private Mortgage in 2019

If you have been turned down for a mortgage before, you may be wondering if homeownership will ever become a reality for you. Generally speaking, private mortgages are the easiest to qualify for but the criteria could vary significantly from lender to lender. In most cases, your credit doesn’t need to be as good as…

Read MoreDo Debt Consolidation Loans Hurt Your Credit Score?

Consolidating your debt using tools such as second mortgages and refinancing can be a great way to lower you monthly interest payments and to help you get out of debt faster. Sometimes however, people are concerned that getting a consolidation loan is going to lower their credit score. Well, the truth is that it can…

Read MoreHow do Private Mortgages Work?

When shopping for a home chances are you’re going to need a mortgage because very few people can buy a home without financing. In order to get a mortgage you will be working with a lender of some kind – a bank, a financial institution or even a mortgage broker – and they will be…

Read MoreHow Much Equity Do I Need for a Second Mortgage?

If you’ve been thinking that a second mortgage might be the right option for you so you can free up some cash flow or consolidate some debt then you likely have some questions about how to qualify for one. Similar to your primary mortgage, when you applied for it, there are certain financial requirements you’ll…

Read MoreHow a Mortgage Agent Can Make the Mortgage Process Easier

When you apply for a mortgage, one of the first decisions that you will have to make is whether to go to your bank, research mortgages on your own, or work with a mortgage agent. Working with your bank is convenient, but since there are no other lenders competing for you business that convenience often…

Read MoreWhat is the minimum credit score I need to get a mortgage?

If you have never paid much attention to your credit score before, it can take you off guard when it is time to apply for a mortgage. In many cases, your credit score is one of the most important determining factors when a lender is deciding whether or not to grant you a mortgage.…

Read MoreShould I Refinance My Mortgage to Pay Off Debt?

We don’t mean to get ourselves into debt: a small emergency here, a couple things come up there and before you know it you find that you’re struggling to make the minimum payments every month. For years you’ve been paying your mortgage and now you own a big chunk of your home, so why not…

Read MoreCan I get a mortgage if I am not a permanent resident?

If you are looking to purchase property in Canada but are not a permanent resident here, you may be wondering if it is possible or if you’ll be able to get a mortgage. The good news is that anyone from anywhere in the world can get a mortgage in Canada. The rules for non-residents however…

Read MoreIs a Second Mortgage Bad for Your Credit?

The term second mortgage is thrown around quite a bit, sometimes it’s used correctly and sometimes it isn’t. There are a number of facts about second mortgages that are important to know before you start the process of applying for one. It’s not a mortgage on a second property A second mortgage is another mortgage…

Read MoreIs a Home Equity Line of Credit a Good Idea

Life has a wonderful way of throwing surprises our way: once you tackle one obstacle it seems like you’ve barely had a chance to breathe before the next one is demanding your time and money. Sometimes your financial obligations just seem overwhelming, and you aren’t alone on that. You can take your biggest asset –…

Read MoreLearn Exactly What Affects Your Credit Score

When you apply for a mortgage, one of the first things that lenders will do is check your credit score. The better your credit score is, the better rate and terms you will be eligible for on your mortgage. If your credit score is too low, some lenders will not even grant you a mortgage…

Read MoreShould I Invest in a Private Mortgage or in Mutual Funds?

With the stock market having so many ups and downs in recent years, it can be difficult for people to know exactly where to invest their money. The traditional choice for many investors has been mutual funds – that is funds consisting of a combination of stocks and bonds chosen by fund investors. Lately however,…

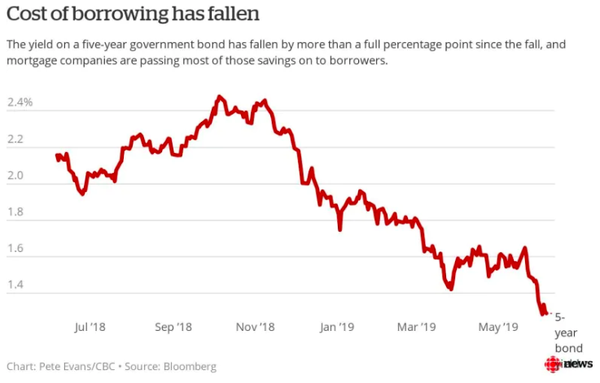

Read More⏱️ Time To Refinance 🏠! Rates At 2-Year Low!

Cost of Borrowing Cheapest in 2 Years! While house prices may be sky-high in many parts of Canada, home owners are being offered some of the lowest mortgage rates seen in years thanks to low bond & Bank of Canada Benchmark Rates. Find Out How Much You Can Save! NOW Is the Perfect time to Refinance your…

Read More2019 has been a great year for mortgages so far

When people begin to think seriously about purchasing a home, one of the things that they are naturally concerned about is whether or not now is a good time to get a mortgage. They consider whether they are ready to take on the responsibility of a mortgage, but they also consider whether the current mortgage…

Read MoreCan You Add Renovation Costs to Your Mortgage?

Home renovations can add a lot of value to your home both in terms of your house’s market value and in terms of your own enjoyment. Major home renovations however can be quite expensive, and if you do not have all of the money saved up, you will have to borrow it from somewhere. One…

Read MoreCan You Be Denied a Mortgage Renewal?

Most people don’t think much about their mortgage renewal until they get a reminder in the mail from their financial institution that their renewal is coming up. But the truth is that mortgage renewal should be something that is always in the back of your mind because while most renewals get approved without too much…

Read MoreDo I have to keep paying the mortgage if I am separated?

When a couple separates, often one will move out while the other continues to live in the marital home. The one that moves out may feel that it is unfair for them to continue to pay a mortgage for a home they no longer live in, however if their name is on the mortgage, they…

Read More